“When are you going to buy the Lambo?”

After having an exit people often asked me what I did with all the money. Initially, when Tim and I started the company, we thought that for sure by age 30 we would be done, and we would celebrate by having a yacht party.

Before you manage money, you really think about money as a destination; at the peak of OpenWater I was generating over $1mm per month in cash and had probably around $800k in a given month’s expenses. Large sums of money now seem like management issues, rather than destinations.

This was helpful experience because when I did finally come into a windfall, I already knew that I needed to be responsible.

The first thing I did was ask a bunch of friends and family for advice on what to do. Later, I came across the Rule #1 of making money: Don’t tell anyone.

Rule #1: Don’t Tell Anyone

When you sell exit business you have worked on your entire life it is hard to keep a lid on your windfall, however there are things you can say, such as the money is in escrow, I don’t get it for a while, not much changes for me today. The exit event is a news event, after the news cycle is over, people will forget quickly.

The problem I faced in asking people for advice was that, people give you advice based on their situation and their worldview of money, in early 2022 the war with Ukraine started, and inflation started picking up. The markets started to tank, and everyday I’d have my mom call me to freak out about my investment choices. I explained to my mom, her freak outs could cause someone to do things in a panic, and best to stay measured.

When I reflect on this, I remember I managed a $10MM budget, that I was personally responsible for. This means I needed to come up with $800k cash every month to pay bills, and do it again next month. I also managed our company cash for 15 years. Back when we had no money, all the way to the end.

Stay diversified, and you’ll be okay. This is everyone’s advice, follow it.

Rule #2: Remember What Life is About

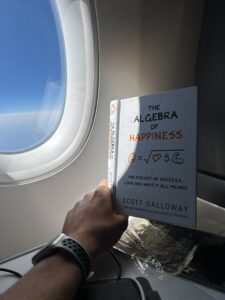

I recommend a quick read of Algebra of Happiness, in this book you’ll quickly be reminded that we all die, and that a successful life is one that we invest in relationships, not in things or even experiences. The book’s advice is to never let your family be hungry or cold. Anything beyond that brings marginal happiness.

Rule #3: You Will Want More Later

In 2007, I wanted to have a party on a boat and invite all of my friends. In 2022, I was comfortable with what I had, I was not really needing anything new, nor did I have any family to take care of. My parents have their health, so really there is nothing to spend money on today except something excessive.

For sure, in 2025 or 2027, I will have wants and desires of keeping up with the jones then. The desire to flex never goes away. Knowing that, I decided to forget I got a windfall, and act as if I don’t.

I still work, I still enjoy working, so let me live within my income, and let me hope that my investments do well over time.

Private Company Investments

I am still an OpenWater shareholder, however my stock is now in the parent company. Because I am an investor and operator, I am exposed to a new world of private finance. I have every incentive to think long term for the parent company. It also gives me a second chance to test my values, that hard work can pay off big. I hope that by 2030, the decision to keep investing in myself and my company pays off big.

I am also the co-founder and owner of API2PDF, Inc. API2PDF is a C-Corp. Had I known about this tax code, OpenWater also would have been a C-Corp. The short of it is, that if you are an original shareholder in a C Corp, that is high tech focused, you can exit completely tax free.

Public Company Investments

I am a believer in the US Stock Market. I chose to invest primarily in the S&P 500, with some allocations in tech. I believe in Microsoft and believe in CloudFlare. Beyond those two riskier bets, I am more or less just in the market. I chose not to dollar cost average, because statistically in the long run, if you buy and hold forever, it works out the same. Also people have a hard time sticking to a dollar cost average strategy, so to avoid letting myself get the best of myself, I invested in ETFs and then forgot about it.

Private Debt

Friends and family may reach out, and in my case, a family friend who runs a bagel franchise wanted to expand to a second location. I have a private note out to a main street business. I did my own due diligence (looked at years of bank statements and financials), and am happy with this decision to prudently help someone in the community, while taking on measured risk.

Private Equity

My business mentor, who was is also my cousin is a general partner at an industrial real estate fund. Think of the bulldozer’s that park on the side of the highway, that’s right some fund owns that land, and I am a LP in one of those funds. Tons of private equity will pitch you on their fund, ultimately, I just blindly trusted the person that helped me get this far in life.

Don’t take any of this as investment advice, I thought it may be helpful to understand what I did. I am very happy with my decisions to forget about my windfall, and continue living life as usual. I had a good life before the exit of my business and this plan worked well for me.

There will always be time to celebrate later, no need to rush.